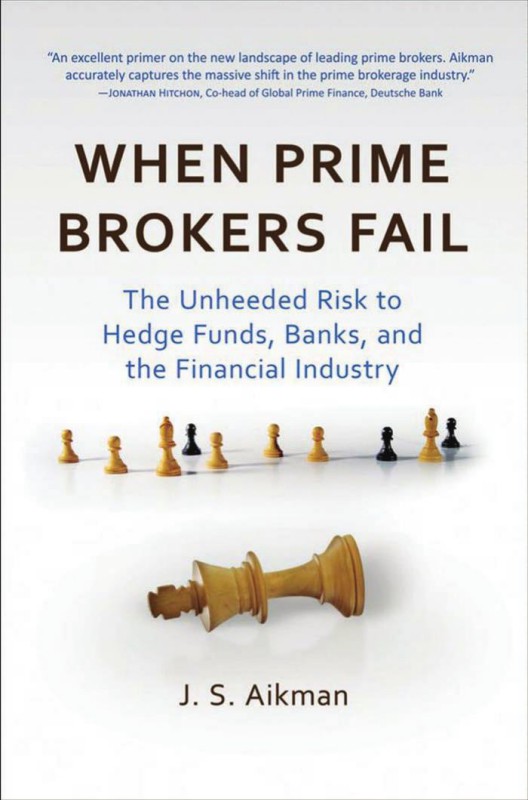

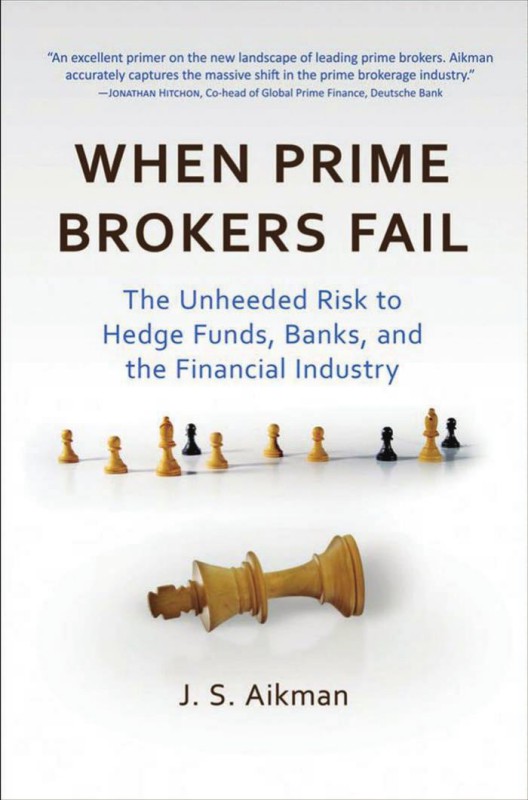

When Prime Brokers Fail The Unheeded Risk to Hedge Funds Banks and the Financial Industry 1st edition by Aikman ISBN 1576603555 978-1576603550

Original price was: $50.00.$25.00Current price is: $25.00.

Authors:J. S. Aikman , Series:Management [52] , Tags:Business & Economics; Investments & Securities; General; 1576603555; 9781576603550; 047087905X; 9780470879054 , Author sort:Aikman, J. S. , Ids:9781576603550 , Languages:Languages:eng , Published:Published:Jul 2010 , Publisher:John Wiley & Sons , Comments:Comments:An informative primer on the new landscape of leading prime brokers Before the recent financial crisis, both regulators and market participants disregarded the complex and dangerous nature of the relationship between prime brokers (the banks) and their clients (the funds). In When Prime Brokers Fail, J. S. Aikman examines the convoluted structure of this relationship, the main participants, and the impact of the near collapse of prime brokerages on the financial world. Filled with in-depth insights and expert advice, When Prime Brokers Fail takes a close look at the unheeded risks of prime finance and lays out the steps required for managers to protect their funds and bankers to protect their brokerages. Examines the challenges, trends, and risks within the prime brokerage space Discusses the structural adjustments firms will need to make to avoid similar disasters Analyzes the complex relationship between hedge funds and their brokerages and the risks that multiply in extraordinary markets Covers new ways to manage an inherently risky business and the regulations that may soon be introduced into this arena Engaging and informative, this timely book details the intricacies and interdependencies of prime brokerages and the role that these operations play in our increasingly dynamic financial system.