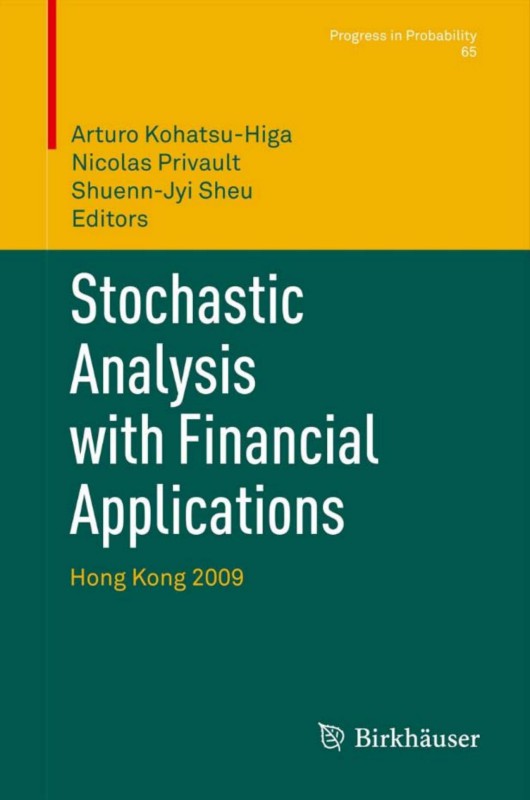

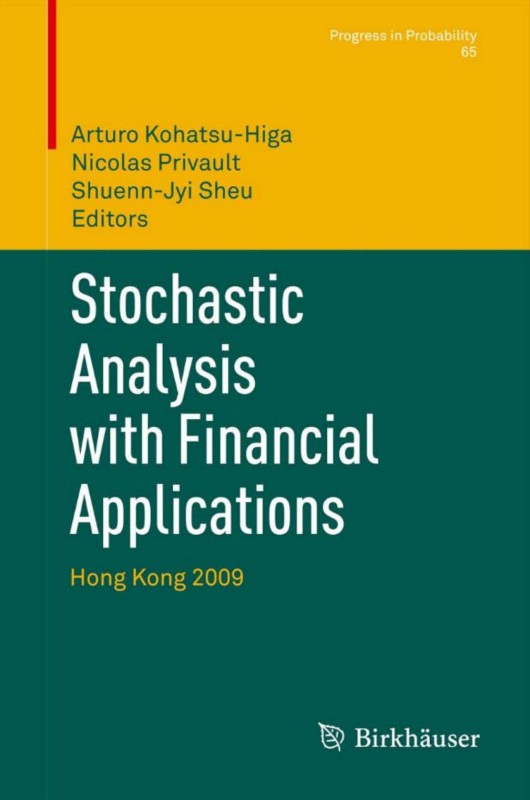

Stochastic Analysis With Financial Applications Hong Kong 2009 1st edition by Arturo Kohatsu Higa,Nicolas Privault,Shuenn Jyi Sheu ISBN 3034800967 978-3034800969

Original price was: $50.00.$25.00Current price is: $25.00.

Authors:Arturo Kohatsu-Higa; Nicolas Privault; Shuenn-Jyi Sheu , Series:Management [68] , Tags:Mathematics; Probability & Statistics; General; Applied; Stochastic Processes; Business & Economics; Accounting; Springer Basel 2011; 3034800967 9783034800969 , Author sort:Kohatsu-Higa, Arturo & Privault, Nicolas & Sheu, Shuenn-Jyi , Ids:9783034800969 , Languages:Languages:eng , Published:Published:Jul 2011 , Publisher:Springer Basel , Comments:Comments:Stochastic analysis has a variety of applications to biological systems as well as physical and engineering problems, and its applications to finance and insurance have bloomed exponentially in recent times. The goal of this book is to present a broad overview of the range of applications of stochastic analysis and some of its recent theoretical developments. This includes numerical simulation, error analysis, parameter estimation, as well as control and robustness properties for stochastic equations. The book also covers the areas of backward stochastic differential equations via the (non-linear) G-Brownian motion and the case of jump processes. Concerning the applications to finance, many of the articles deal with the valuation and hedging of credit risk in various forms, and include recent results on markets with transaction costs.