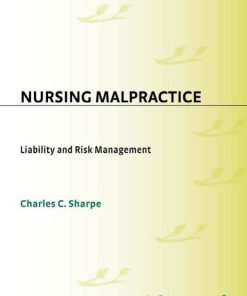

Risk and financial management mathematical and computational methods 1st Edition by Charles Tapiero ISBN 0470849088 9780470849088

$50.00 Original price was: $50.00.$25.00Current price is: $25.00.

Authors:CHARLES TAPIERO , Series:Management [771] , Author sort:TAPIERO, CHARLES , Languages:Languages:eng , Published:Published:Sep 2004 , Publisher:Wiley

Risk and financial management mathematical and computational methods 1st Edition by Charles Tapiero – Ebook PDF Instant Download/Delivery. 0470849088 ,9780470849088

Full download Risk and financial management mathematical and computational methods 1st Edition after payment

Product details:

ISBN 10: 0470849088

ISBN 13: 9780470849088

Author: Charles Tapiero

Financial risk management has become a popular practice amongst financial institutions to protect against the adverse effects of uncertainty caused by fluctuations in interest rates, exchange rates, commodity prices, and equity prices. New financial instruments and mathematical techniques are continuously developed and introduced in financial practice. These techniques are being used by an increasing number of firms, traders and financial risk managers across various industries. Risk and Financial Management: Mathematical and Computational Methods confronts the many issues and controversies, and explains the fundamental concepts that underpin financial risk management.

- Provides a comprehensive introduction to the core topics of risk and financial management.

- Adopts a pragmatic approach, focused on computational, rather than just theoretical, methods.

- Bridges the gap between theory and practice in financial risk management

- Includes coverage of utility theory, probability, options and derivatives, stochastic volatility and value at risk.

- Suitable for students of risk, mathematical finance, and financial risk management, and finance practitioners.

- Includes extensive reference lists, applications and suggestions for further reading.

Risk and Financial Management: Mathematical and Computational Methods is ideally suited to both students of mathematical finance with little background in economics and finance, and students of financial risk management, as well as finance practitioners requiring a clearer understanding of the mathematical and computational methods they use every day. It combines the required level of rigor, to support the theoretical developments, with a practical flavour through many examples and applications.

Risk and financial management mathematical and computational methods 1st Edition Table of contents:

Chapter 1: Foundations of Risk Management

- Definition of Risk in Financial Contexts

- Types of Risks: Market, Credit, Operational, and Liquidity

- Risk Identification and Measurement

- The Role of Risk Management in Financial Decision Making

Chapter 2: Mathematical and Statistical Foundations

- Probability Theory and Its Application in Risk Management

- Stochastic Processes and Random Variables

- Statistical Models in Risk Assessment

- Common Distributions Used in Financial Modeling

Chapter 3: Financial Instruments and Markets

- Overview of Financial Instruments: Stocks, Bonds, Derivatives

- Financial Markets and Their Structure

- The Role of Financial Instruments in Risk Management

- Pricing of Financial Instruments and Market Behavior

Chapter 4: Risk Quantification and Measurement Models

- Value at Risk (VaR) Models

- Conditional Value at Risk (CVaR)

- Stress Testing and Scenario Analysis

- Measuring Credit Risk and Counterparty Risk

Chapter 5: Optimization Techniques in Risk Management

- Linear and Non-linear Optimization in Finance

- Portfolio Optimization and Asset Allocation

- Capital Asset Pricing Model (CAPM) and Arbitrage Pricing Theory (APT)

- Risk-Return Trade-off and Optimization Algorithms

Chapter 6: Computational Methods for Risk and Financial Analysis

- Simulation Techniques: Monte Carlo and Other Methods

- Numerical Solutions to Stochastic Differential Equations

- Computational Finance and Algorithmic Trading

- Applications of Artificial Intelligence and Machine Learning in Risk Management

Chapter 7: Market Risk Management

- Measuring and Managing Market Risk Exposure

- The Role of Hedging in Risk Mitigation

- Derivatives and Their Use in Managing Market Risk

- Case Studies on Market Risk in Financial Institutions

Chapter 8: Credit Risk Management

- Understanding Credit Risk and Default Probability

- Credit Risk Models: Structural and Reduced Form Models

- Credit Derivatives and Securitization

- Managing Credit Risk in Banks and Financial Institutions

Chapter 9: Operational Risk Management

- Definition and Categories of Operational Risk

- Tools for Managing Operational Risk

- Case Studies in Operational Risk

- Role of Internal Controls and Compliance

Chapter 10: Liquidity Risk and Funding Liquidity

- Understanding Liquidity Risk in Financial Markets

- Measurement of Liquidity Risk

- Managing Funding Liquidity in Financial Institutions

- Case Studies on Liquidity Crises and Their Management

Chapter 11: Risk in Financial Derivatives and Structured Products

- Overview of Derivatives and Structured Products

- Pricing and Valuation of Derivatives

- Managing Risk in Derivatives Trading

- Complex Financial Products and Their Risk Profiles

Chapter 12: Integrated Risk Management Framework

- Combining Market, Credit, Operational, and Liquidity Risk

- Developing a Risk Management Framework for Financial Institutions

- Risk Culture and Governance

- The Role of Regulation and Compliance in Risk Management

Chapter 13: Risk Management in Practice: Real-world Applications

- Case Studies of Risk Management Failures and Successes

- Risk Management in Financial Crises

- Implementing Risk Management Strategies in Banks and Investment Firms

- Ethical Considerations in Financial Risk Management

Chapter 14: The Future of Risk and Financial Management

- Emerging Risks and Their Implications

- The Impact of Technology on Risk Management

- Trends in Global Financial Markets

- Preparing for Future Challenges in Risk and Financial Management

Appendix

- Mathematical Tables

- Additional Resources for Risk Management and Computational Finance

- Glossary of Terms

People also search for Risk and financial management mathematical and computational methods 1st Edition:

mathematics financial analysis and risk management salary

mathematics financial analysis and risk management reddit

mathematics & statistics for financial risk management

financial mathematics and risk management

You may also like…

eBook PDF

Quantitative Financial Risk Management 1st edition by Desheng Dash Wu ISBN 3642268900 978-3642268908

eBook PDF

Essentials of Financial Risk Management 1st Edition by Karen Horcher 0471706167 9780471706168