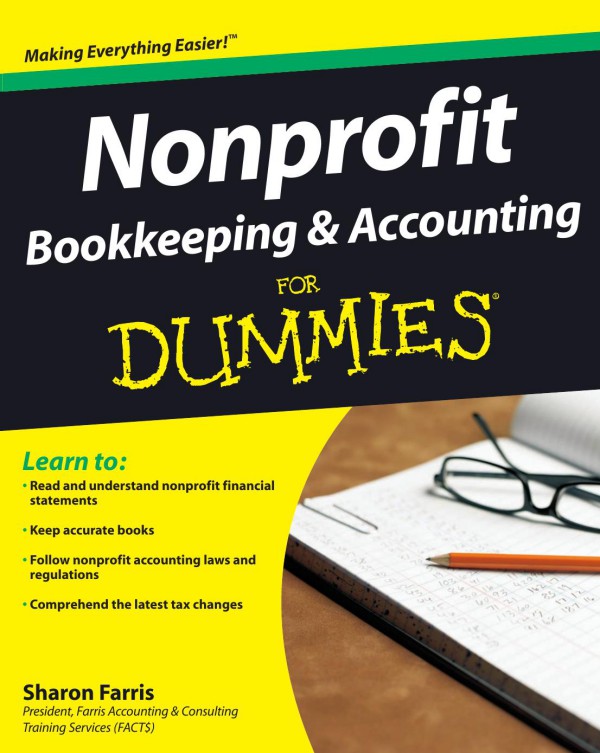

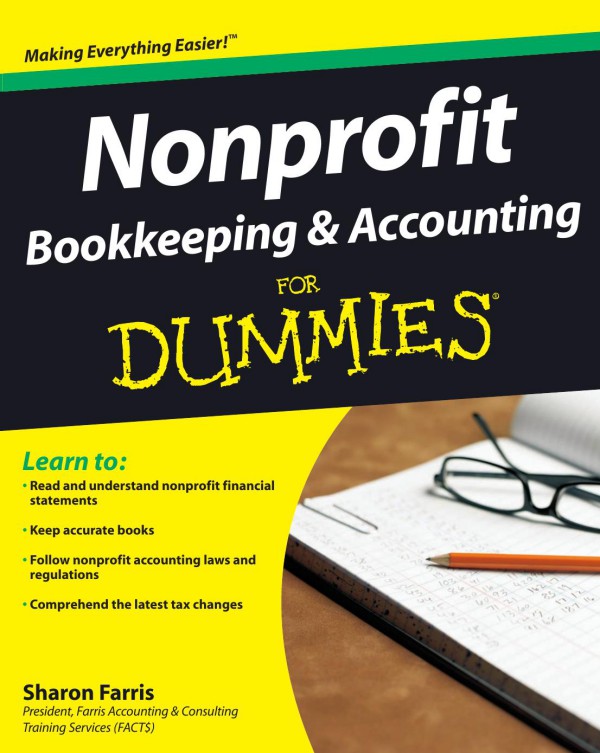

Nonprofit Bookkeeping and Accounting for Dummies 1st edition by Sharon Farris 0470432365 9780470432365

Original price was: $50.00.$25.00Current price is: $25.00.

Authors:Sharon Farris , Series:Management [113] , Tags:Business & Economics; Nonprofit Organizations & Charities; Finance & Accounting; General; Bookkeeping; Political Science; Public Affairs & Administration , Author sort:Farris, Sharon , Ids:9780470432365 , Languages:Languages:eng , Published:Published:May 2009 , Publisher:John Wiley & Sons , Comments:Comments:Your hands-on guide to keeping great records and keeping your nonprofit running smoothly Need to get your nonprofit books in order? This practical guide has everything you need to know to operate your nonprofit according to generally accepted accounting principles (GAAP) — from documenting transactions and budgeting to filing taxes, preparing financial statements, and much more. You’ll see how to stay organized, keep records, and be prepared for an audit. Begin with the basics — understand common financial terms, choose your accounting methods, and work with financial statements Balance your nonprofit books — set up a chart of accounts, record transactions, plan your budget, and balance your cash flow Get the 4-1-1 on federal grants — find grants and apply for them, track and account for federal dollars, and prepare for a grant audit Stay in good standing with Uncle Sam — set up payroll accounts for employees, calculate taxes and deductions, and complete tax forms Close out your books — prepare the necessary financial statements, know which accounts to close, and prepare for the next accounting cycle Know what to do if you get audited — form an internal audit committee, follow IRS rules of engagement, and keep an immaculate paper trail Open the book and find: The difference between bookkeeping and accounting How to maintain a manual or computer record-keeping system Ten vital things to know when keeping the books Do’s and don’ts of managing federal grant money How to prepare for an audit of your financial statements IRS Form 990 good practices The most common errors found during nonprofit audits How to figure out employee payroll deductions and taxes