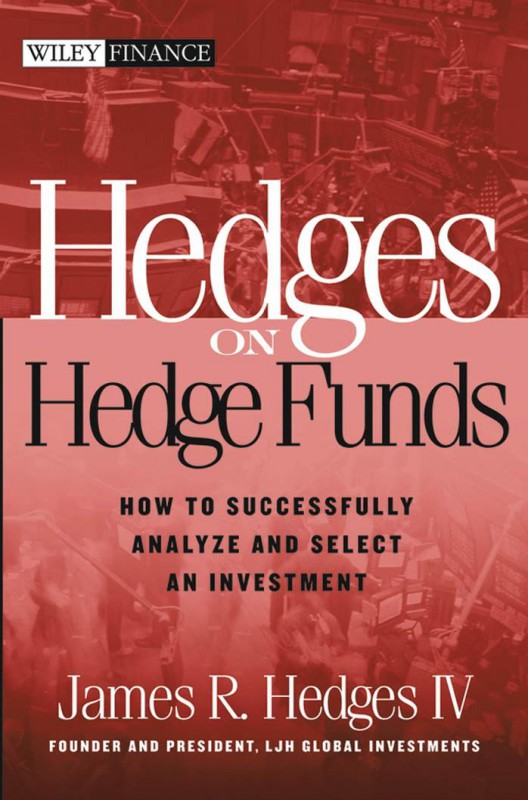

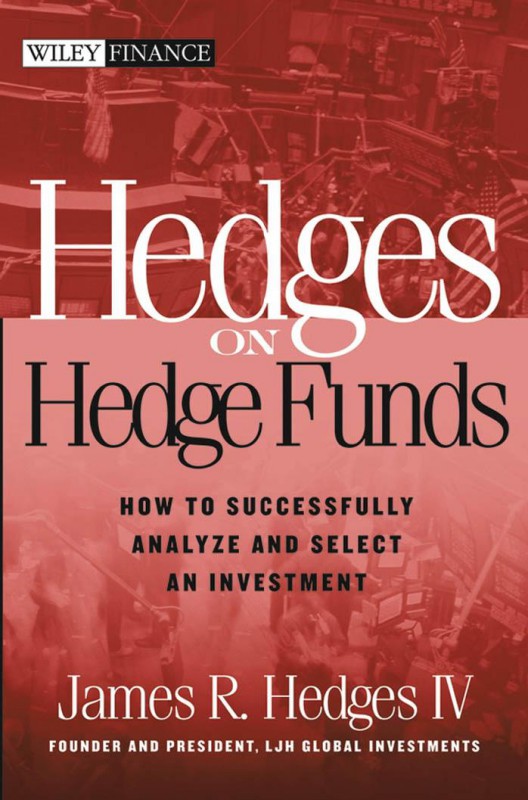

Hedges on Hedge Funds How to Successfully Analyze and Select an Investment 1st edition by James Hedges ISBN 0471625108 ‎ 978-0471625100

Original price was: $50.00.$25.00Current price is: $25.00.

Authors:James R. Hedges, Iv , Series:Management [49] , Tags:Business & Economics; Finance; General , Author sort:James R. Hedges, Iv , Ids:9780471701026 , Languages:Languages:eng , Published:Published:Nov 2004 , Publisher:John Wiley & Sons , Comments:Comments:A just-in-time guide to hedge fund investing Today, access to hedge funds is increasingly available to average investors through “funds of hedge funds” and other registered products. These vehicles allow investors to invest as little as $25,000 to start. Hedges on Hedge Funds provides an overview of hedge fund investing and delves into the key investment strategies employed by hedge fund managers. This comprehensive resource directs people to proper fund selection and allocation, but most importantly, it helps investors avoid the potential pitfalls associated with the industry by discussing transparency, size vs. performance, and other important issues associated with selecting and profiting with hedge funds. James R. Hedges, IV (Naples, FL), is recognized as a pioneer in the hedge fund industry for his efforts to monitor and review funds and fund managers for performance and transparency. He is the founder, President, and Chief Investment Officer of LJH Global Investments-an investment advisory firm that helps clients select and invest in hedge funds.