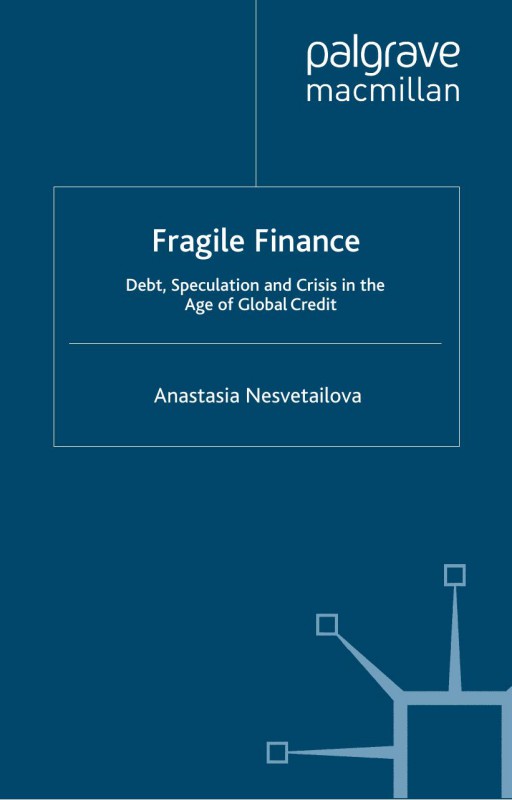

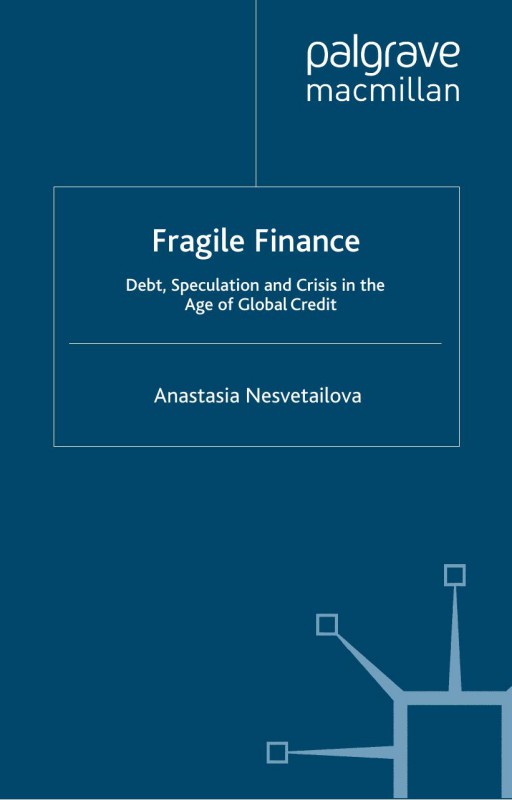

Fragile Finance Debt Speculation and Crisis in the Age of Global Credit 1st Edition by Anastasia Nesvetailova 0230006906 9780230006904

$50.00 Original price was: $50.00.$25.00Current price is: $25.00.

Authors:Anastasia Nesvetailova , Series:Management [667] , Author sort:Nesvetailova, Anastasia , Languages:Languages:eng , Published:Published:Aug 2008 , Publisher:Palgrave

Fragile Finance Debt Speculation and Crisis in the Age of Global Credit 1st Edition by Anastasia Nesvetailova – Ebook PDF Instant Download/Delivery. 0230006906, 9780230006904

Full download Fragile Finance Debt Speculation and Crisis in the Age of Global Credit 1st Edition after payment

Product details:

ISBN 10: 0230006906

ISBN 13: 9780230006904

Author: Anastasia Nesvetailova

Fragile Finance examines financial crisis in the era of global credit. Drawing on the work of Hyman Minsky, the book discusses the global financial system over the past decade, suggesting that financial fragility stems from an explosive combination of financial innovation, over-borrowing, and progressive illiquidity of financial structures.

Fragile Finance Debt Speculation and Crisis in the Age of Global Credit 1st Table of contents:

1 The Rise of Fragile Finance

The post-World War II international financial regime

Deregulation and privatisation

Financial innovation

Finance as a global system

2 A Theory of Fragile Finance

Efficient market theory of finance: Crisis? What crisis?

Why EMT is not a theory of crisis

Mutation of the orthodoxy

3 Keynesian and Heterodox Theories of Financial Crises

Money, finance and speculation

International political economy and the ‘disjuncture paradigm’

The errors of the disjuncture thesis

4 Hyman Minsky and Fragile Finance

The financial instability hypothesis

Minskyan financial fragility in the international context

5 Dilemmas and Paradoxes of Fragile Finance

Destabilising stability

The illusions of liquidity

A new type of crisis

6 The East Asian Crisis: A Minskyan View

The rise of financial fragility in East Asia

The Thai crisis

The South Korean crisis

Crisis contagion

Illiquidity and Minskyan debt deflation in East Asia

7 Ponzi Capitalism Russian-style

Russian laissez-faire

Speculation, Ponzi finance and debt

The crisis

A Minskyan crisis?

8 Ponzi Finance Goes Global

Brazil, 1999

Turkey, 2000–2001

Argentina, 2001

Financial fragility in the emerging markets: some lessons

Minskyan crises in the U.S. economy

After the crises

Conclusion

Central banks and illiquidity

Towards a new post-Keynesian financial architecture?

People also search for Fragile Finance Debt Speculation and Crisis in the Age of Global Credit 1st:

financial fragility definition

financial fragility financial

fragility examples

fragile 5

You may also like…

eBook PDF

Financial Crisis and Credit Default Swaps 1st Edition by Muhammad Raheem, Atif Masood, Salman Akbar