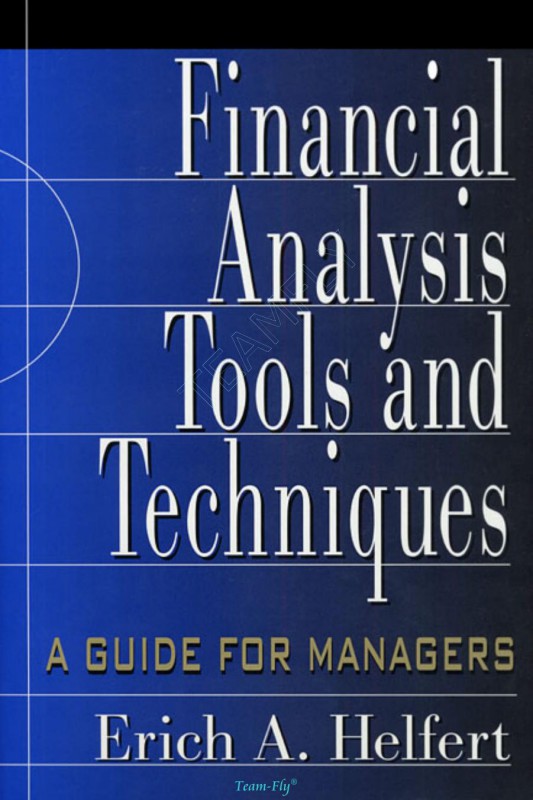

Financial Analysis Tools And Techniques A Guide For Managers 1st Edition by Erich Helfert 0071378340 9780071378345

$50.00 Original price was: $50.00.$25.00Current price is: $25.00.

Authors:Erich A.Helfert , Author sort:A.Helfert, Erich , Languages:Languages:eng , Published:Published:May 1999

Financial Analysis Tools And Techniques A Guide For Managers 1st Edition by Erich Helfert – Ebook PDF Instant Download/Delivery. 0071378340, 9780071378345

Full download Financial Analysis Tools And Techniques A Guide For Managers 1st Edition after payment

Product details:

ISBN 10: 0071378340

ISBN 13: 9780071378345

Author: Erich A. Helfert

Praise for Financial Analysis Tools and Techniques: ‘Bona fide treasury for executives, managers, entrepreneurs. Have long used this great work in corporate & university programs. Uniquely makes the arcane clear.’Allen B. Barnes, Provost, IBM Advanced Business Institute ‘A candidate for every consultant-to-management’s bookshelf. Its beauty lies in the dynamic model of the business system and its management decision framework.’Stanley Press CMC, Book review in C2M Consulting to Management Journal ‘Goes a long way to remove the mystery from business finance. Approach allows managers from all areas to understand how their decisions impact shareholder value.’Stephen E. Frank, Chairman and Chief Executive Officer, Southern California Edison ‘Helfert has rare ability to make financial concepts understandable to those lacking financial background. His finance seminars exceeded our high expectations.’L. Pendleton Siegel, Chairman and Chief Executive Officer, Potlatch Corporation ‘Commend the clarity, organization and currency of contents. There is no other book available that does the task in such an understandable and accessible way.’Dr. Thomas F. Hawk, Frostburg State University ‘Helfert’s excellent overviews and simplified models effectively broadened our managers’ understanding of their fiscal responsibility to HP and our shareholders.’Robert P. Wayman, Executive Vice President, Chief Financial Officer, Hewlett-Packard Company ‘The book has become a classic, and Helfert has been of substantial help to my company in teaching our people how to think about the numbers which drive it.’Robert J. Saldich, President and Chief Executive Officer, Raychem Corporation ‘Helfert has contributed to the development of financial skills of TRW managers through his book, case studies and presentations, and highly rated instruction.’Peter S. Hellman, President and Chief Operating Officer, TRW Inc. ‘Helfert has the ability to make financial concepts understandable, and his credibility and content added significantly to the success of our educational effort.’Giulio Agostini, Senior Vice President Finance, and Office Administration, 3M Corporation ‘Helfert’s writing and teaching have become a mainstay for us, and his business and strategic sense have been recognized as valuable guides to our process.’William H. Clover, Ph.D.,

Financial Analysis Tools And Techniques A Guide For Managers 1st Table of contents:

Chapter 1: The Challenge of Financial/Economic Decision-Making

Lessons for the Millennium

The New Economy

Some Key Questions

The Basics Never Change

The Economic Manager

Understanding Business Economics

Appropriate Economic Tools

The Practice of Financial/Economic Analysis

Day-to-Day Decisions and Operational Planning

Supporting Strategy Development

Performance Assessment and Incentives

Valuation and Investor Communication

The Value Creating Company

Relevant Decision Information

Economic Incentives

Total Systems Management

Summary

Chapter 2: A Systems Context For Financial Management

A Dynamic Perspective of Business

Decision Context

The Business System

Investment Decisions

Operating Decisions

Financing Decisions

Interrelationship of Strategy and Value Creation

The Nature of Financial Statements

The Balance Sheet

The Income Statement

The Cash Flow Statement

The Statement of Changes in Shareholders’ (Owners’) Equity

The Context of Financial Analysis

Key Issues

Summary

Analytical Support

Selected References

Chapter 3: Managing Operating Funds

Funds Flow Cycles

The Funds Cycle for Manufacturing

The Funds Cycle for Sales

The Funds Cycle for Services

Variability of Funds Flows

Growth/Decline Variations

Seasonal Variations

Cyclical Variations

Generalized Funds Flow Relationships

Interpreting Funds Flow Data

Funds Management and Shareholder Value

Cash Management

Working Capital Management

Investment Management

Key Issues

Summary

Analytical Support

Selected References

Chapter 4: Assessment of Business Performance

Ratio Analysis and Performance

Management’s Point of View

Operational Analysis

Gross-Margin and Cost-of-Goods-Sold Analysis

Profit Margin

Operating Expense Analysis

Contribution Analysis

Resource Management

Asset Turnover

Working Capital Management

Profitability

Return on Assets (ROA or RONA)

Return on Assets before Interest and Taxes

Owners’ Point of View

Investment Return

Return on Equity (Shareholders’ Investment)

Return on Common Equity (ROE)

Earnings per Share

Cash Flow per Share

Share Price Appreciation

Total Shareholder Return (TSR)

Disposition of Earnings

Dividends per Share

Dividend Yield

Payout/Retention

Dividend Coverage

Dividends to Assets

Market Indicators

Price/Earnings Ratio

Cash Flow Multiples

Market-to-Book Ratio

Relative Price Movements

Value Drivers

Value of the Firm

Lenders’ Point of View

Liquidity

Current Ratio

Acid Test

Quick Sale Value

Financial Leverage

Debt to Assets

Debt to Capitalization

Debt to Equity

Debt Service

Interest Coverage

Burden Coverage

Fixed Charges Coverage

Cash Flow Analysis

Ratios as a System

Elements of Return on Assets

Elements of Return on Equity

Integration of Financial Performance Analysis

Some Special Issues

Inventory Costing

Depreciation Methods

The Impact of Inflation

Key Issues

Summary

Analytical Support

Selected References

Chapter 5: Projection of Financial Requirements

Pro Forma Financial Statements

Pro Forma Income Statement

Pro Forma Balance Sheet

Pro Forma Cash Flow Statement

Cash Budgets

Operating Budgets

Sales Budget

Production Budget

Interrelationship of Financial Projections

Financial Modeling

Sensitivity Analysis

Key Issues

Summary

Analytical Support

Selected References

Chapter 6: Dynamics and Growth of the Business System

Leverage

Operating Leverage

Effect of Lower Fixed Costs

Effect of Lower Variable Costs

Effect of Lower Prices

Multiple Effects on Break-Even Conditions

Target Profit Analysis

Financial Leverage

Financial Growth Plans

Basic Financial Growth Model

Sustainable Growth and the Sustainable Growth Equation

Integrated Financial Plan

Key Issues

Summary

Analytical Support

Selected References

Chapter 7: Cash Flows and the Time Value of Money

The Time Value of Money

Discounting, Compounding, and Equivalence

Components of Analysis

Net Investment

Net Operating Cash Inflows

Economic Life

Terminal (Residual) Value

Methods of Analysis

Simple Measures

Payback

Simple Rate of Return

Economic Investment Measures

Net Present Value

Present Value Payback

Profitability Index (BCR)

Internal Rate of Return (IRR, Yield)

Annualized Net Present Value

Applying Time-Adjusted Measures

Key Issues

Summary

Analytical Support

Selected References

Chapter 8: Analysis of Investment Decisions

Strategic Perspective

Decisional Framework

Problem Definition

Nature of the Investment

Future Costs and Benefits

Incremental Cash Flows

Relevant Accounting Data

Sunk Costs

Refinements of Investment Analysis

A Machine Replacement

Net Investment Refined

Operating Cash Inflows Refined

Unequal Economic Lives

Capital Additions and Recoveries

Analytical Framework

A Business Expansion

Mutually Exclusive Alternatives

Maintain versus Replace

Full-Fledged versus Economy Solution

Comparing Different Scenarios

Dealing with Risk and Changing Circumstances

Specifying Risk

Ranges of Estimates

Business Investments as Options

Probabilistic Simulation

Risk-Adjusted Return Standards

When to Use Investment Measures

Some Further Considerations

Leasing—A Financing Choice

Accelerated Depreciation

Inflation and Investment Analysis

Accuracy

Key Issues

Summary

Analytical Support

Selected References

Chapter 9: Cost of Capital and Business Decisions

Decisional Context

Investment Decisions

Operating Decisions

Financing Decisions

Cost of Operating Funds

Cost of Long-Term Debt

Cost of Shareholders’ Equity

Preferred Stock

Common Equity

Dividend Approach to Cost of Common Equity

Risk Assessment Approach to Cost of Common Equity

Inflation

Weighted Cost of Capital

Cost Choices

Weighting the Proportions

Market versus Book Values

Calculating the Weighted Cost of Capital

Cost of Capital and Return Standards

Cost of Capital as a Cutoff Rate

Risk Categories

Cost of Capital in Multibusiness Companies

Multiple Rate Analysis

Key Issues

Summary

Analytical Support

Selected References

Chapter 10: Analysis of Financing Choices

Framework for Analysis

Cost of Incremental Funds

Risk Exposure

Flexibility

Timing

Control

The Choice

Techniques of Calculation

Current Performance

Long-Term Debt in the Capital Structure

Preferred Stock in the Capital Structure

Common Stock in the Capital Structure

Range of Earnings Chart

The Optimal Capital Structure

Some Special Forms of Financing

Leasing

Convertible Securities

Stock Rights

Warrants

Key Issues

Summary

Analytical Support

Selected References

Chapter 11

Chapter 11: Valuation and Business Performance

Definitions of Value

Economic Value

Market Value

Book Value

Liquidation Value

Breakup Value

Reproduction Value

Collateral Value

Assessed Value

Appraised Value

Going Concern Value

Shareholder Value

Value to the Investor

Bond Values

Bond Yields

Bond Provisions and Value

Preferred Stock Values

Preferred Stock Provisions and Value

Common Stock Values

Earnings and Common Stock Value

Common Stock Yield and Investor Expectations

Other Considerations in Valuing Common Stock

Specialized Valuation Issues

Rights and Warrants

Options

Business Valuation

Valuing the Equity

Valuing the Total Company

Using Shortcuts in Valuing an Ongoing Business

Key Issues

Summary

Analytical Support

Selected References

Chapter 12: Managing for Shareholder Value

Shareholder Value Creation in Perspective

Evolution of Value-Based Methodologies

A Review of Key Measures

Earnings Measures

Cash Flow Measures

Value Measures

Economic Profit and CFROI

Creating Value in Restructuring and Combinations

Restructuring and Value

Combinations and Synergy

Combinations and Share Values

Integration of Value Analysis

Perspectives

Expectations

Time Period

Cash Flow Pattern

Ongoing Values

Comparables

Negotiations

Key Issues

Summary

Analytical Support

Selected References

Appendix 1: Financial Analysis Using Financial Genome

Financial Genome as a Financial Analysis and Planning Tool

Financial Genome as a Learning Device and Guide

How to Obtain Financial Genome

Appendix 2: Glossary of Key Terms and Concepts

Appendix 3: Financial Information and On-Line Sources

Current Financial Information

Stock Quotations

On-Line Stock Market Data

On-Line Company Data

Printed Stock Market Data

Foreign Exchanges

Mutual Funds

Options

Bond Quotations

Other Financial Data

Foreign Exchange

Financial and Economic Information

Business and Economic Magazines

Major Periodicals

Other Periodicals

Other Background Information

Annual Reports

Financial Manuals and Services

Business to Government Reporting

Trade Associations

Econometric Services

Selected References

Appendix 4: Basic Inflation Concepts

Price Level Changes

Monetary Inflation

Nominal and Real Dollars

Applications of Inflation Adjustment in Financial Analysis

Impact of Inflation

Appendix 5: Some Issues in Multinational Financial Analysis

General Performance Analysis Challenges

International Performance Analysis Challenges

Foreign Subsidiaries Operating in a Single Country

Subsidiaries Operating across Foreign Borders

People also search for Financial Analysis Tools And Techniques A Guide For Managers 1st:

financial analysis tools and techniques

tools of financial analysis and planning

tools of financial analysis

different tools of financial analysis